Table of Links

III. TDA Approach to analyzing multiple time series

A. Obtaining point cloud from stock price time-series

B. EE due to the 2008 Financial crisis

C. EE due to COVID-19 pandemic

D. Impact of COVID-19 on different Indian sectors

VII. Acknowledgments and References

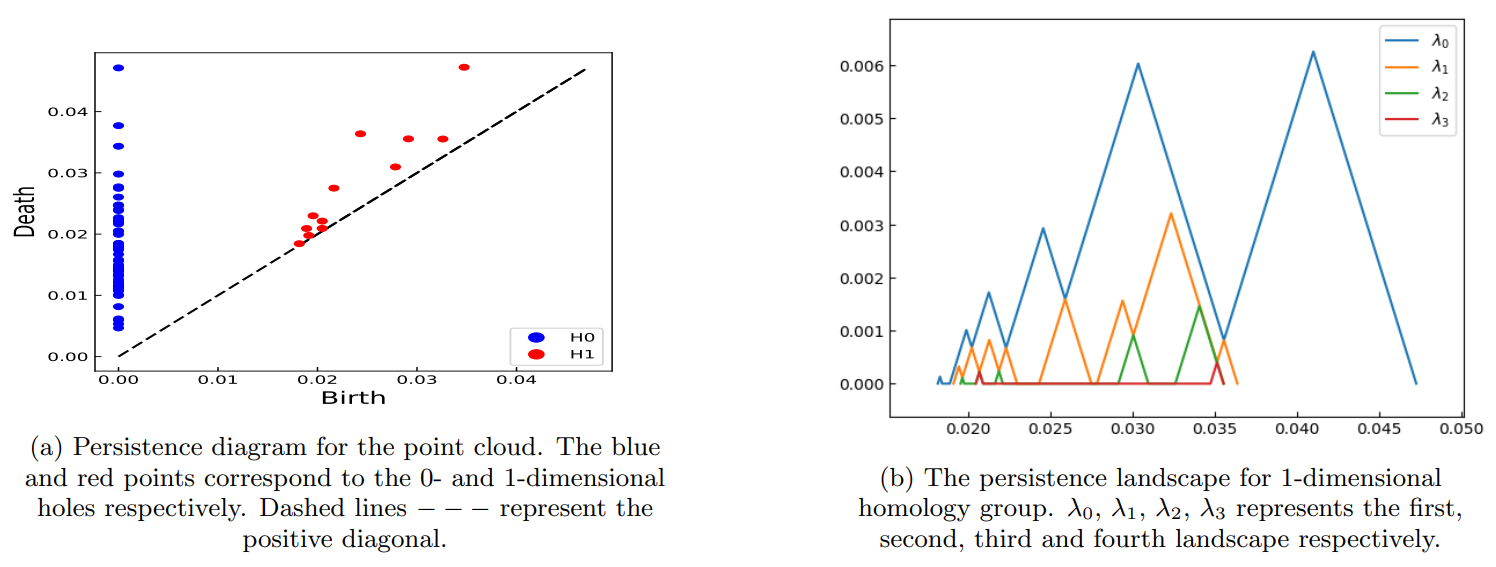

V. RESULTS AND DISCUSSION

This section shows the result of the identification of continent-wise extreme events (EEs) during the 2008 financial crisis and the COVID-19 pandemic using TDA. It allows the identification of EEs from multiple stock time series at once. Also, a sector-wise impact of the COVID-19 pandemic is analyzed in the Indian stock market.

:::info

Authors:

(1) Anish Rai, Department of Physics, National Institute of Technology Sikkim, Sikkim, India-737139;

(2) Buddha Nath Sharma, Department of Physics, National Institute of Technology Sikkim, Sikkim, India-737139;

(3) Salam Rabindrajit Luwang, Department of Physics, National Institute of Technology Sikkim, Sikkim, India-737139;

(4) Md.Nurujjaman, Department of Physics, National Institute of Technology Sikkim, Sikkim, India-737139;

(5) Sushovan Majhi, Data Science Program, George Washington University, USA, 20052.

:::

:::info

This paper is available on arxiv under CC BY 4.0 DEED license.

:::