ATOM Climbs 4% Amid Bullish Momentum and Consolidation Near Key Support Zone

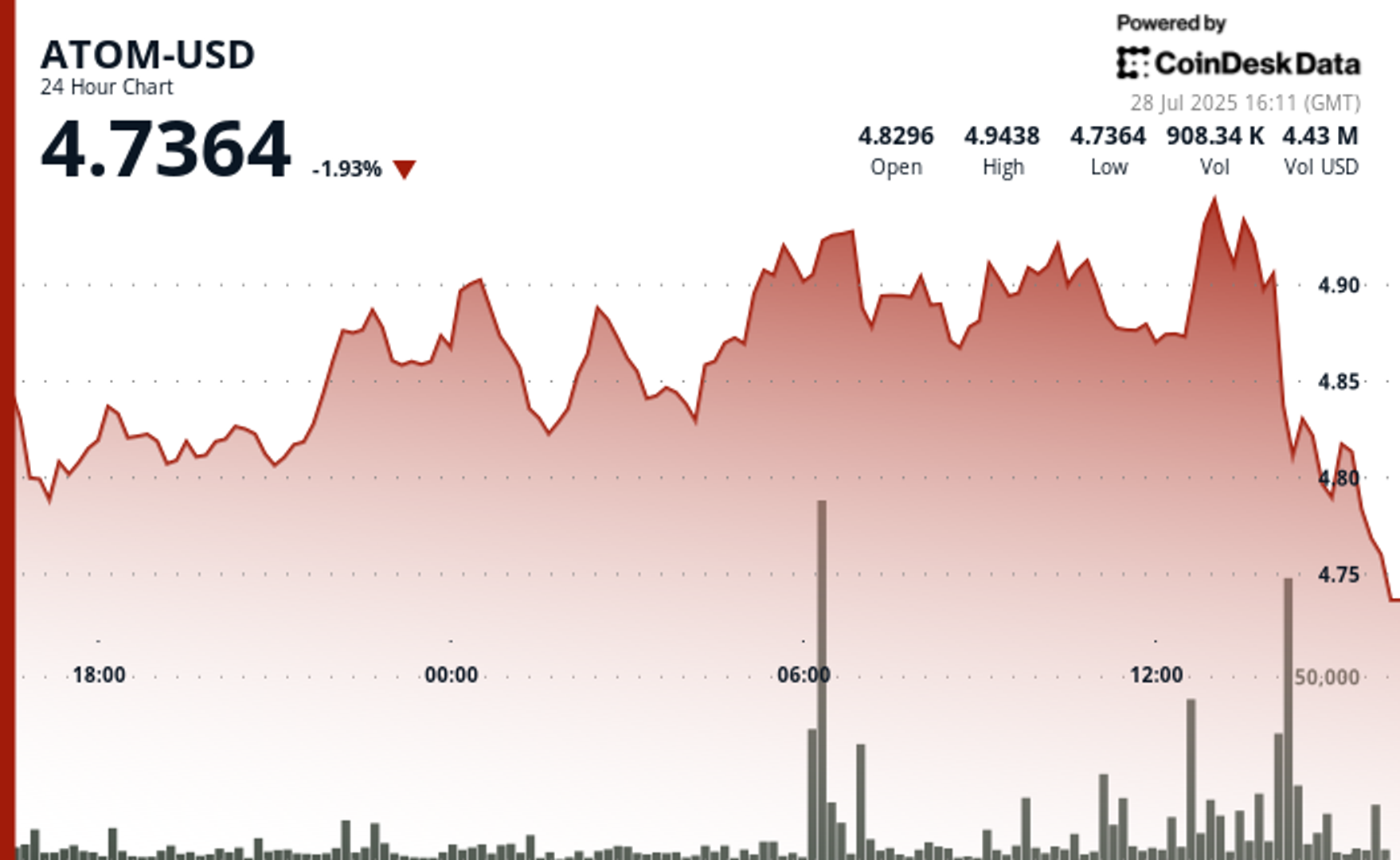

Cosmos’ native token ATOM posted a robust 4% gain over the past 24 hours, surging from $4.78 to $4.89 between July 27 at 15:00 and July 28 at 14:00 UTC. The token’s bullish advance was supported by clear technical signals, including multiple higher lows and a decisive breakout above the $4.84 resistance level, powered by … Read more