Altcoin Rally Fizzles as Ether Turns 10: Crypto Daybook Americas

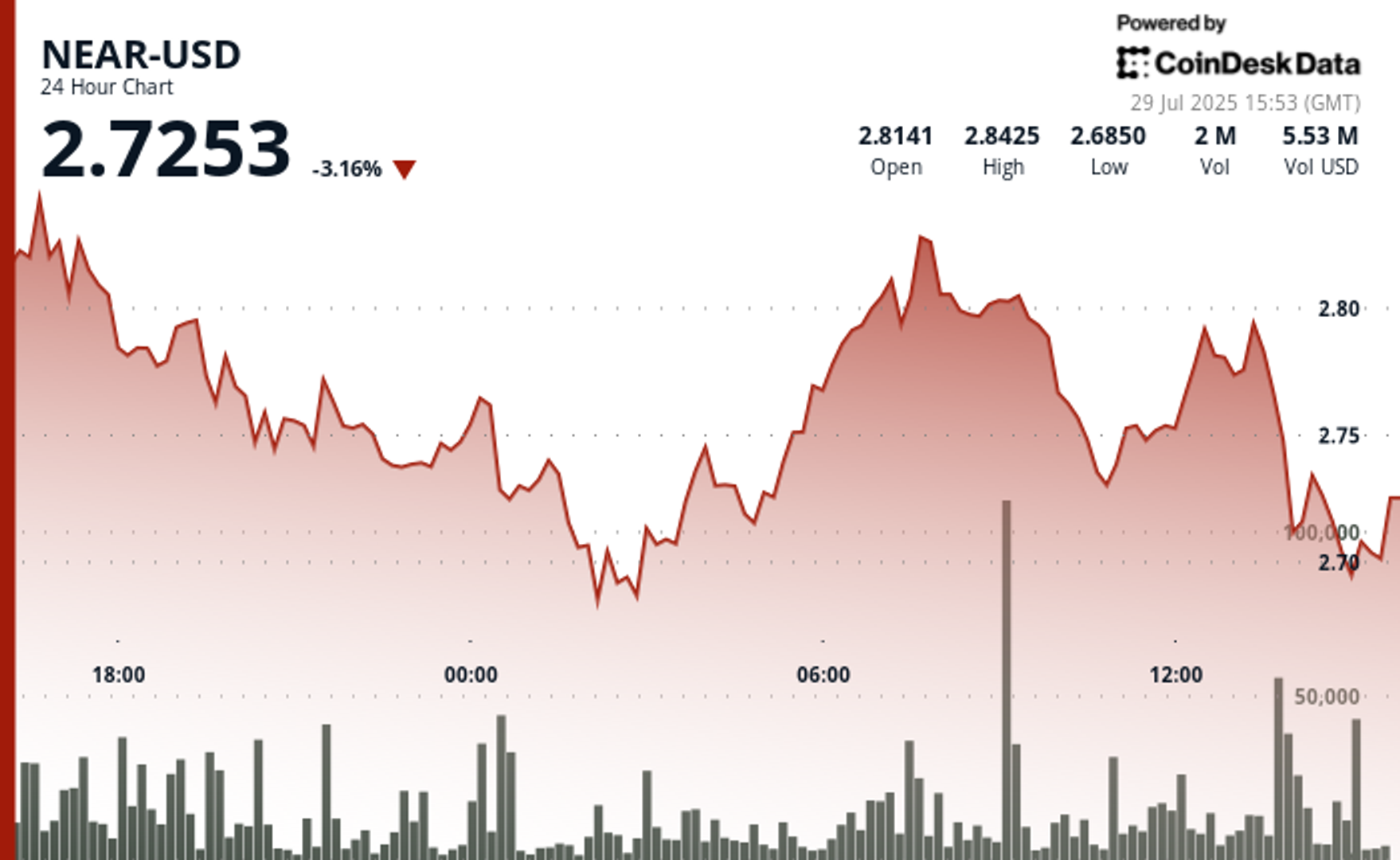

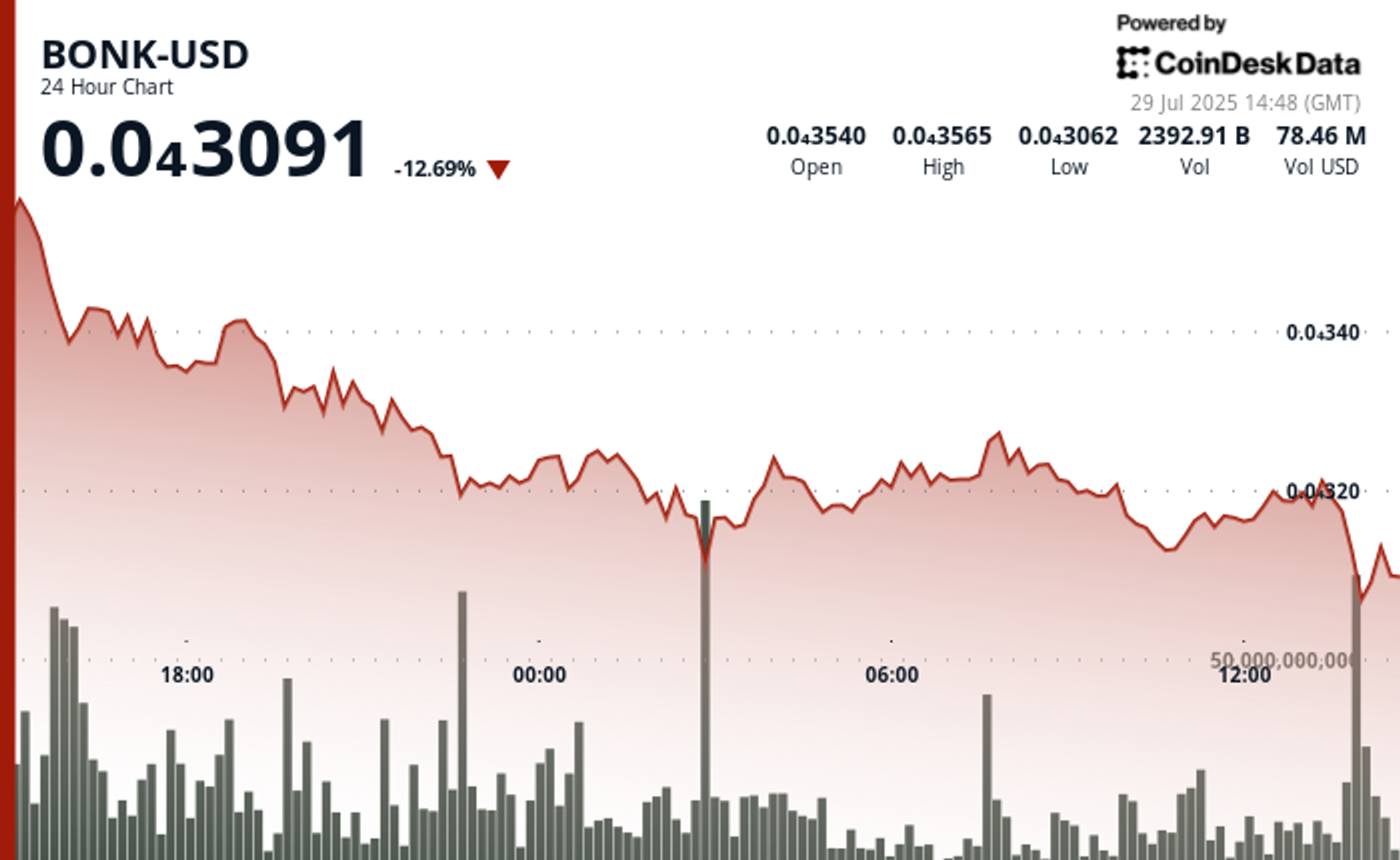

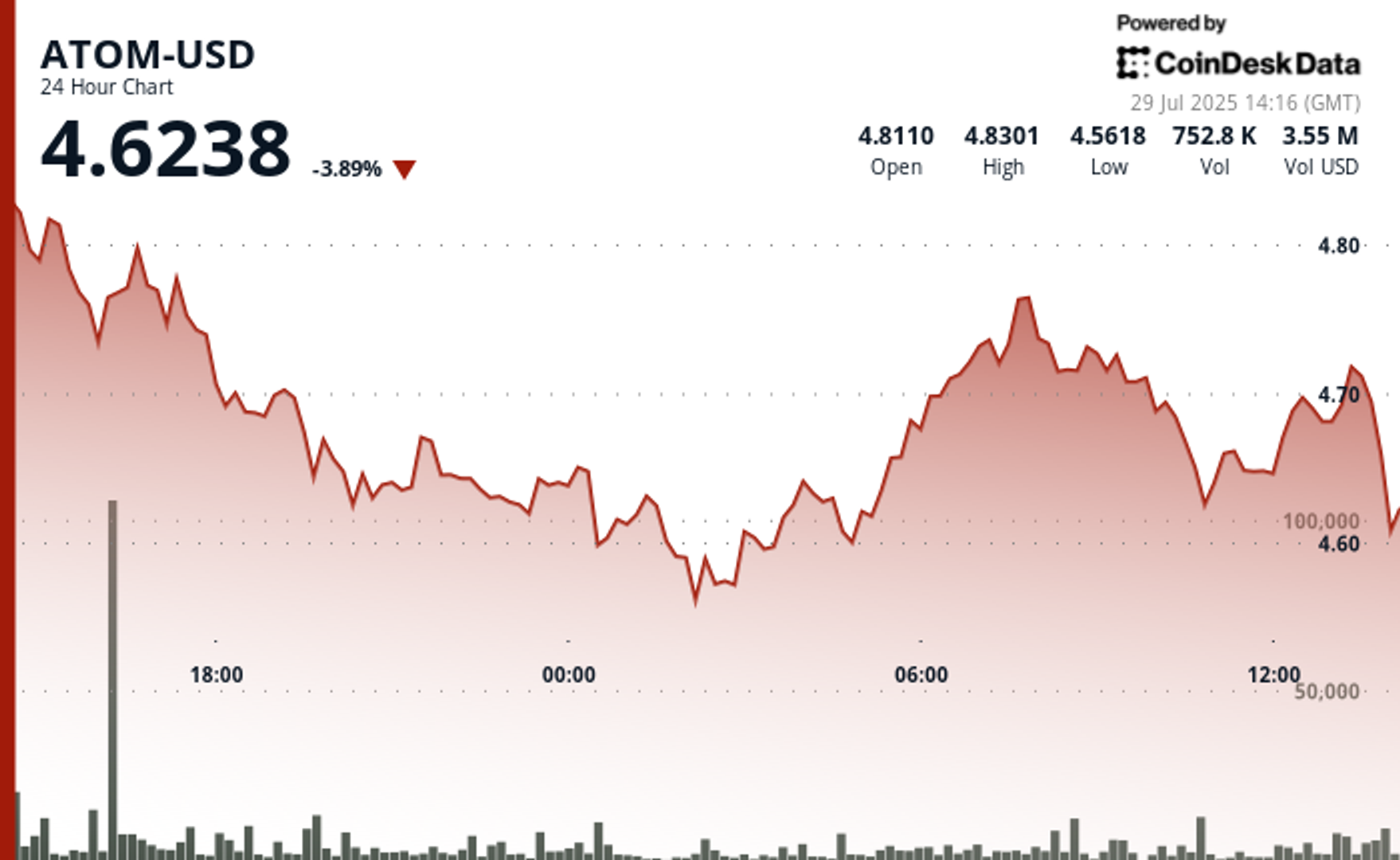

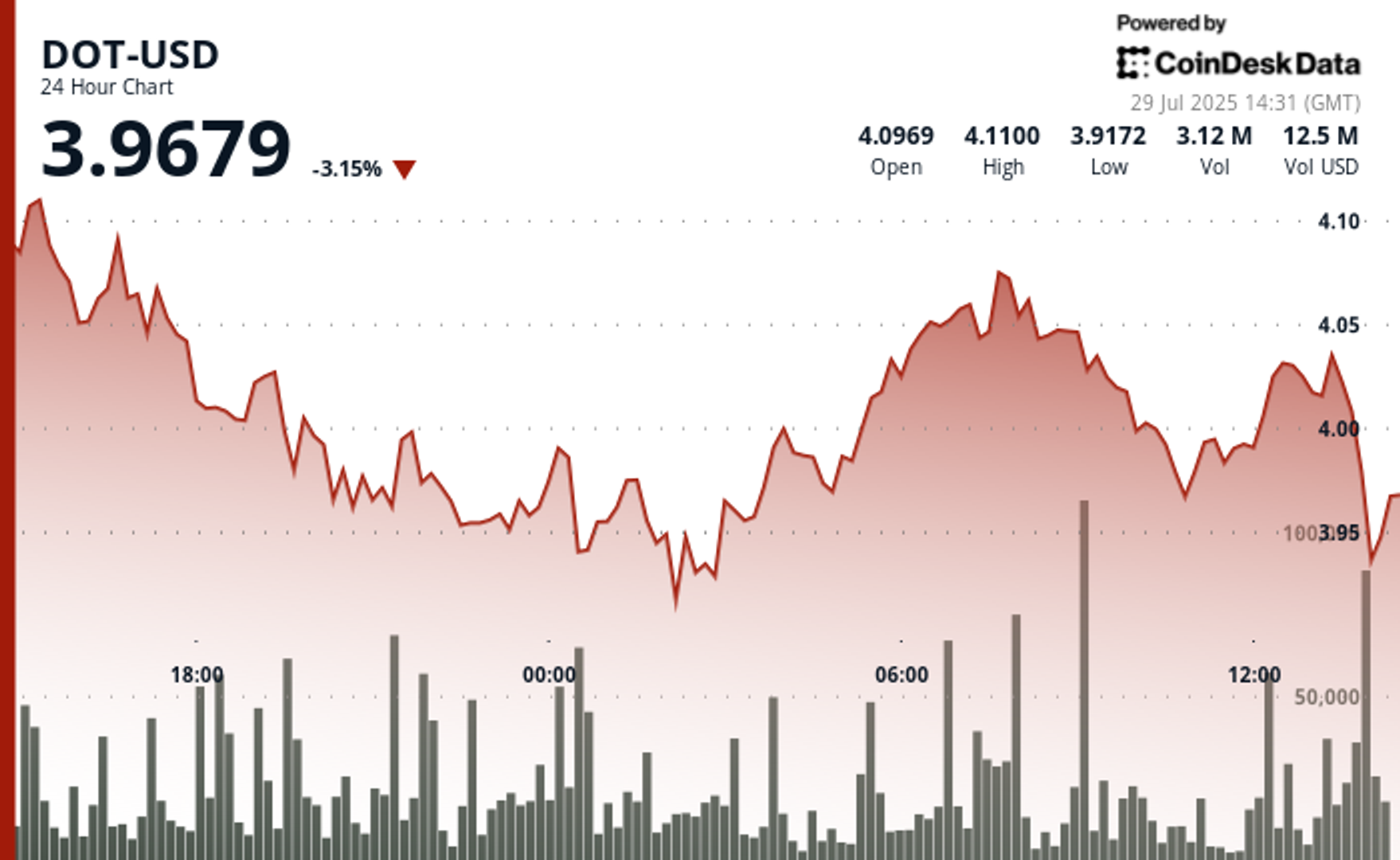

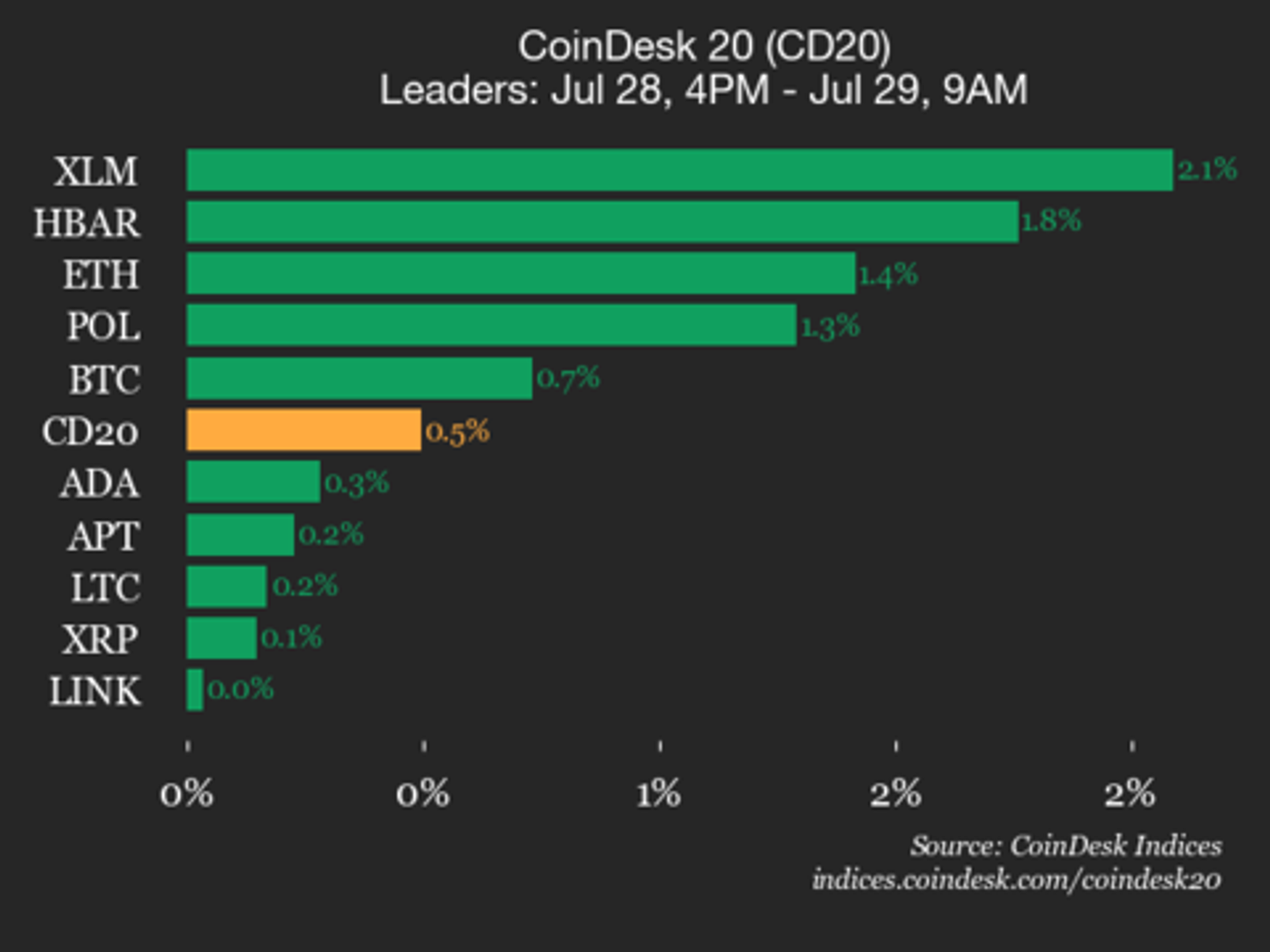

By Francisco Rodrigues (All times ET unless indicated otherwise) Bitcoin (BTC) is holding its own as the broader crypto market declines in the run-up to today’s Federal Reserve monetary policy decision and a slew of data later this week. The CoinDesk 20 Index (CD20) has fallen 1.6% in the past 24 hours, while bitcoin is … Read more