Stellar’s XLM Rebounds From $0.38 Lows as Institutional Demand Fuels Recovery

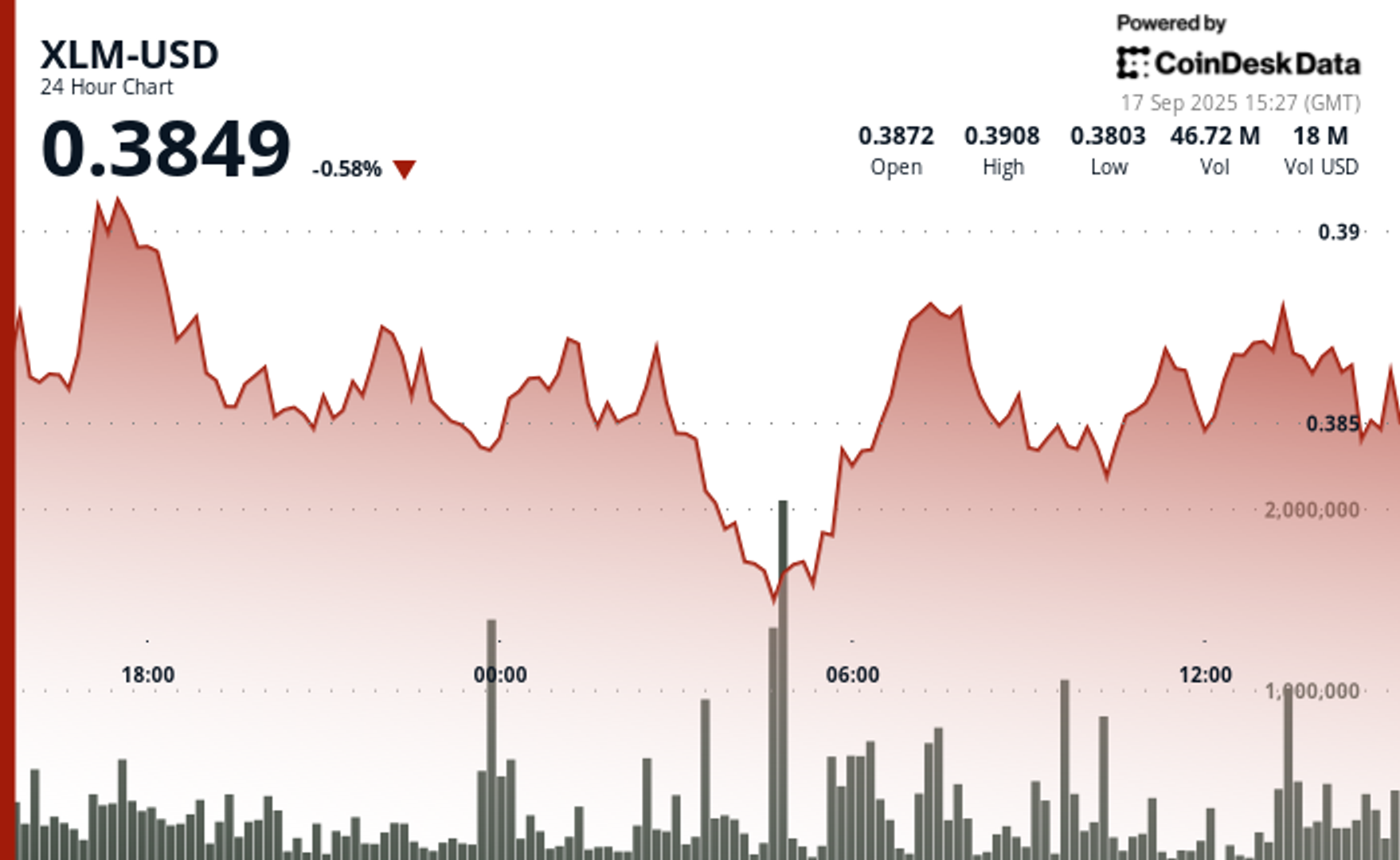

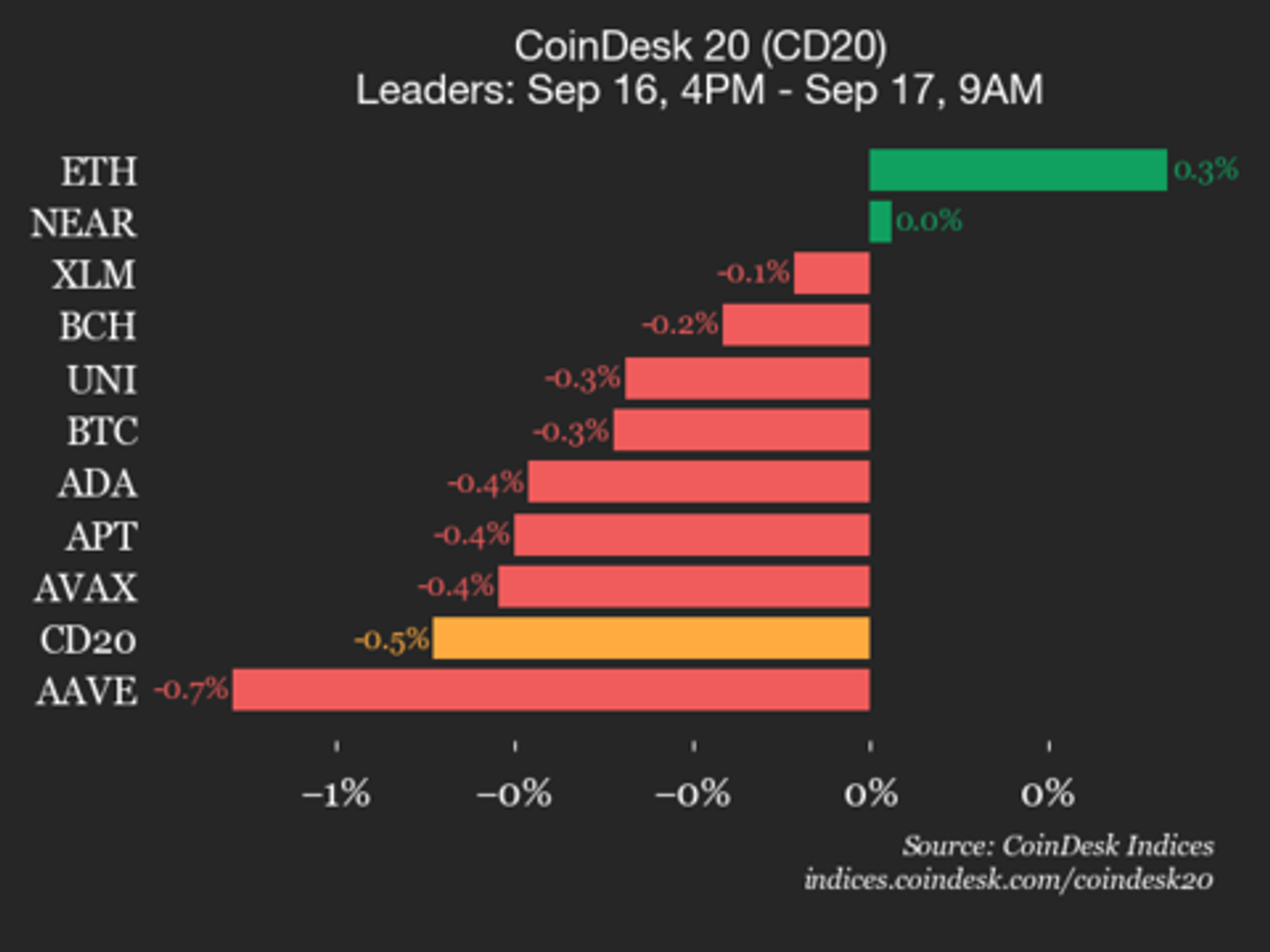

XLM rebounded strongly after facing overnight selling pressure, with the token climbing back above $0.39 during European trading hours on Tuesday. The move followed a sharp dip that saw the asset fall from $0.39 at 2 a.m. UTC to $0.38 by 4 a.m., marking the session’s steepest decline. Elevated trading activity around the $0.38 level … Read more