Aster Leads Hyperliquid in Revenue as DEX War Heats Up: Crypto Daybook Americas

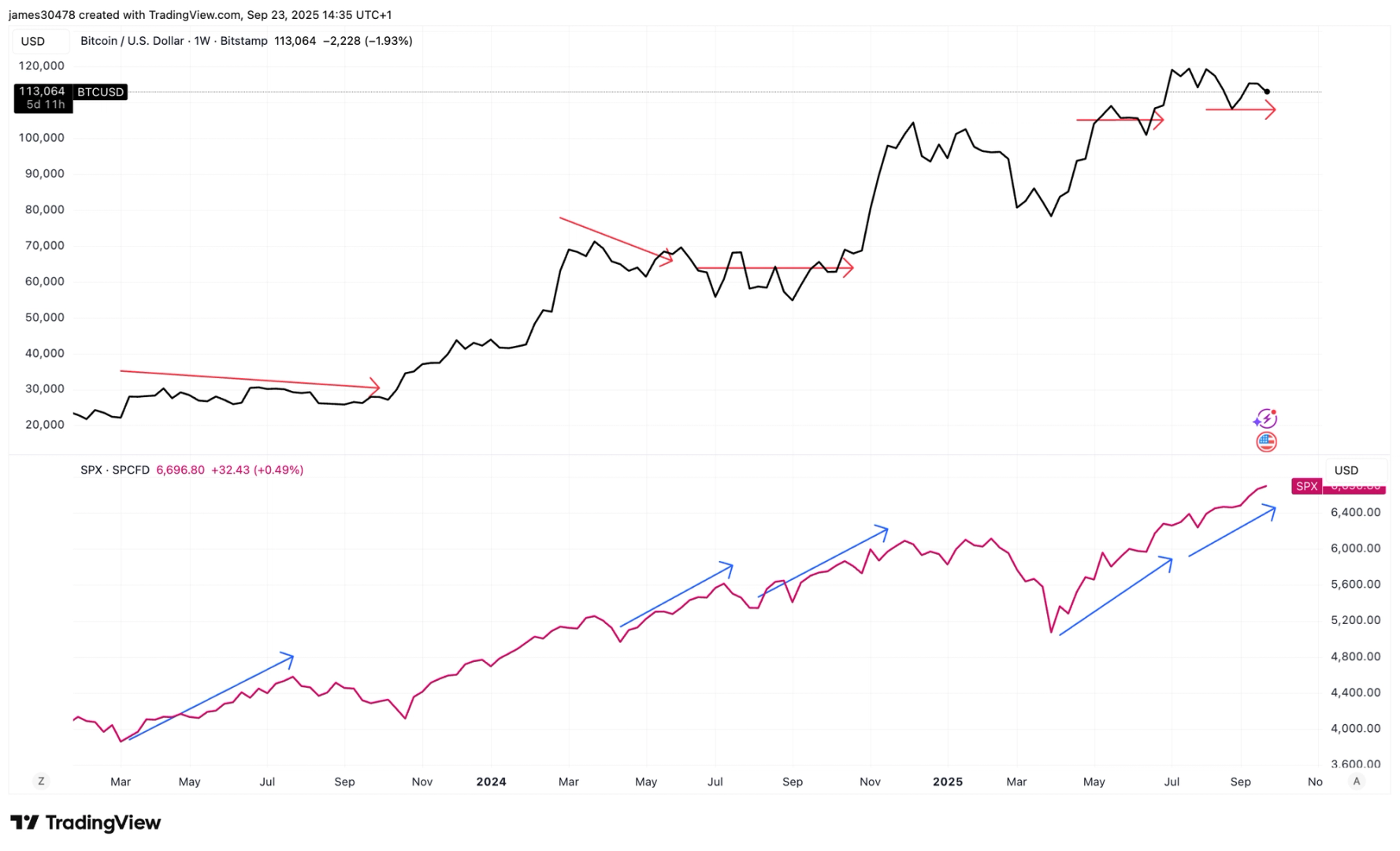

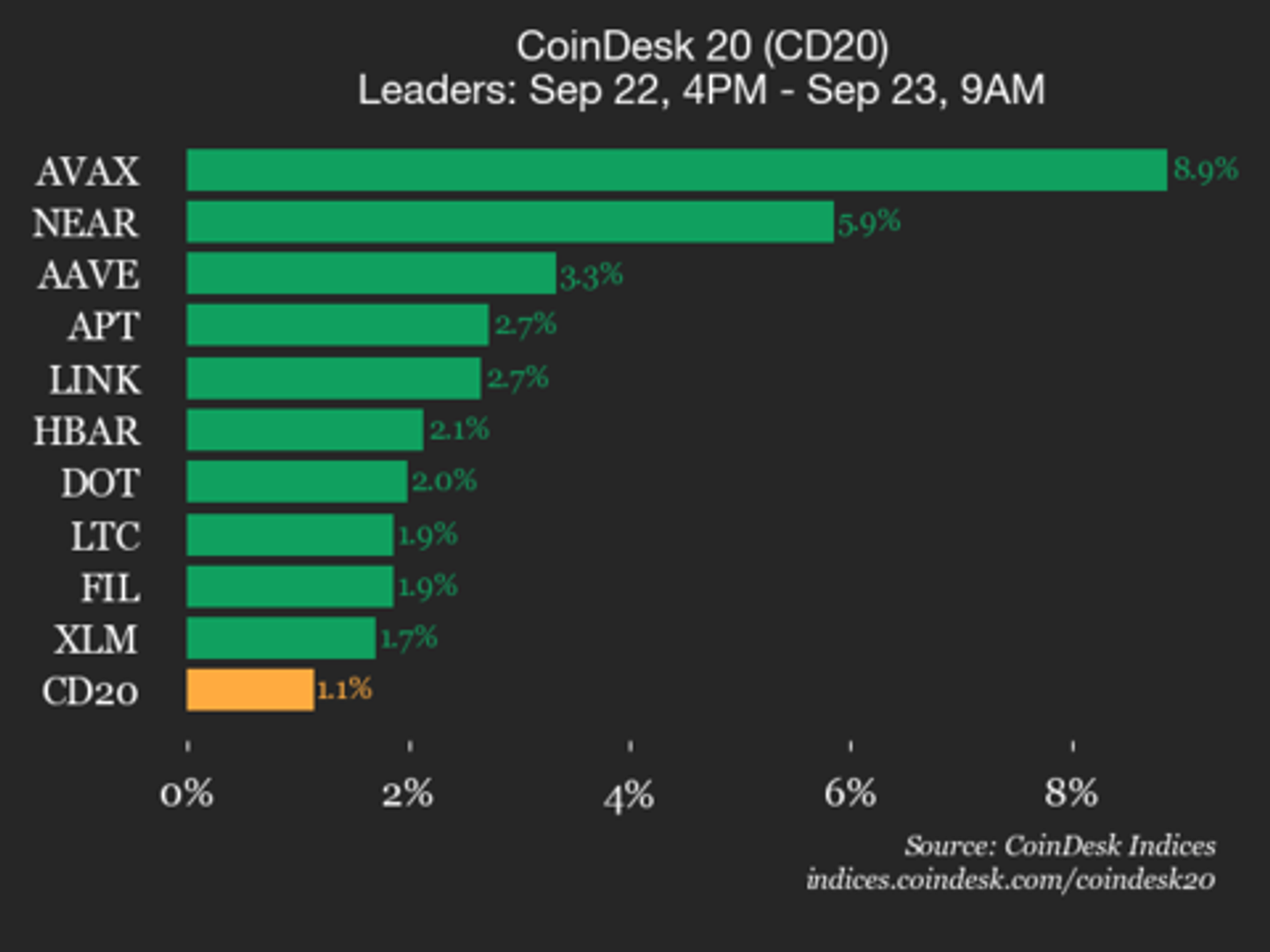

By Omkar Godbole (All times ET unless indicated otherwise) Bitcoin (BTC) rebounded from Asian session lows of $111,000 to $112,800, repeating a pattern seen on Tuesday. However, the token remains below its 50- and 100-day simple moving averages (SMAs), with liquidity analysis and retail crowd sentiment signaling a potential for a deeper pullback. The CoinDesk … Read more