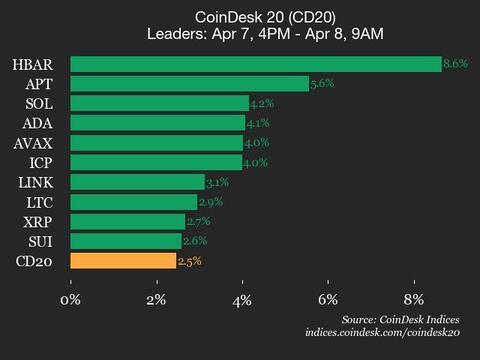

CoinDesk 20 Performance Update: HBAR Gains 8.6% as Nearly All Assets Trade Higher

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index. The CoinDesk 20 is currently trading at 2309.92, up 2.5% (+55.35) since 4 p.m. ET on Monday. Nineteen of the 20 assets are trading higher. Leaders: HBAR (+8.6%) and APT (+5.6%). Laggards: FIL (+0.0%) and AAVE … Read more