Table of Links

2. Financial Market Model and Worst-Case Optimization Problem

3. Solution to the Post-Crash Problem

4. Solution to the Pre-Crash Problem

5. A BSDE Characterization of Indifferences Strategies

Acknowledgments and References

Appendix A. Proofs from Section 3

Appendix B. Proofs of BASDE Results from Section 5

Appendix C. Proofs of (CIR) Results from Section 6

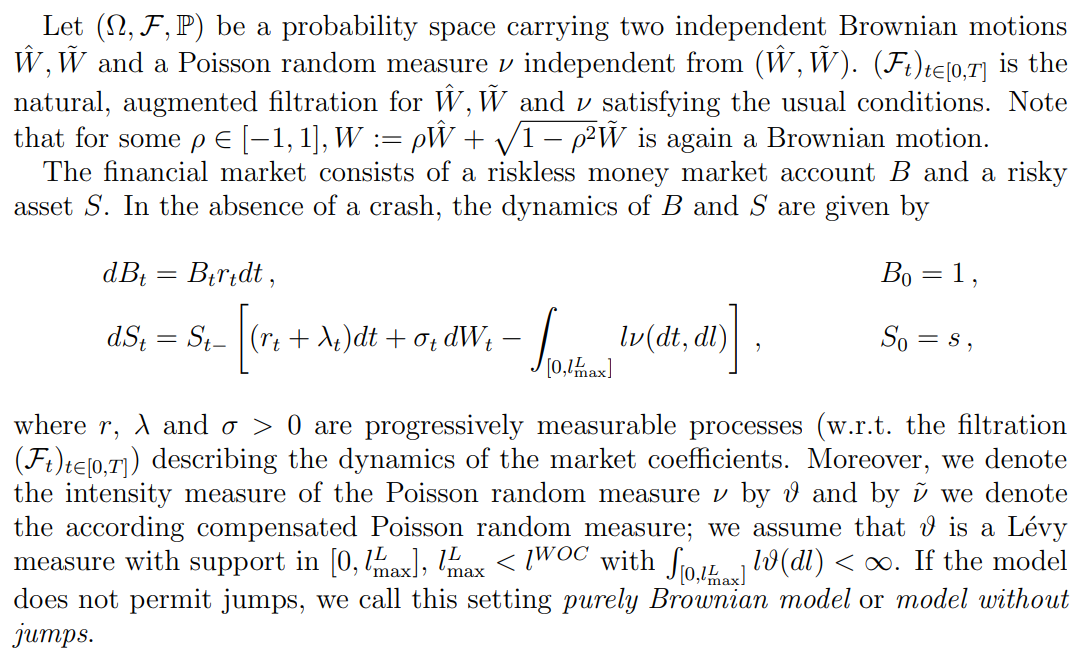

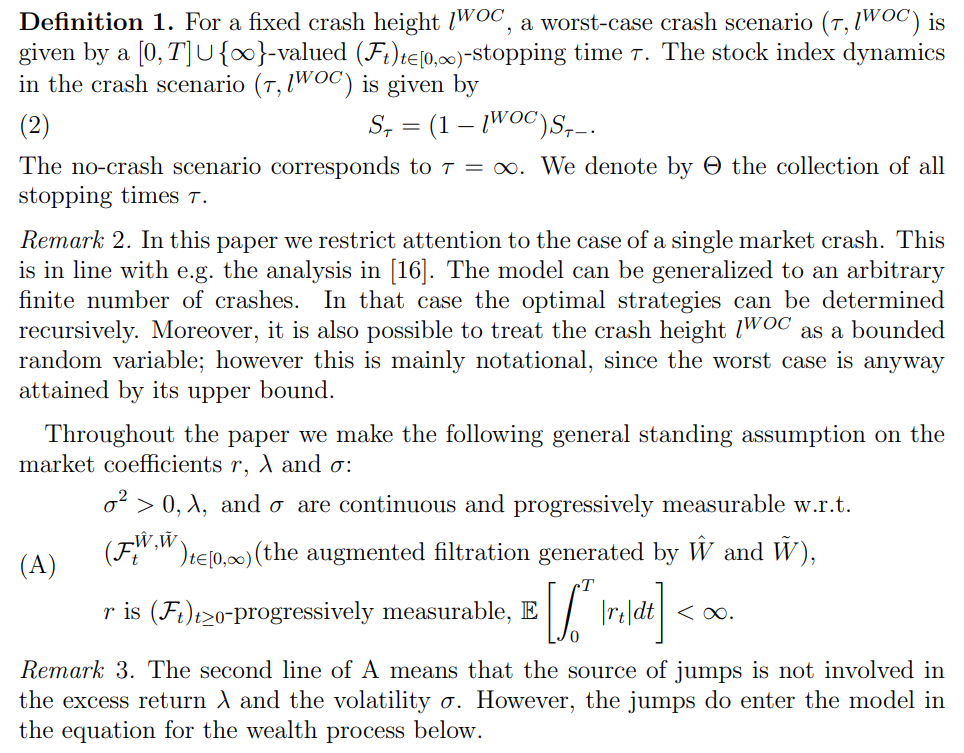

2. Financial Market Model and Worst-Case Optimization Problem

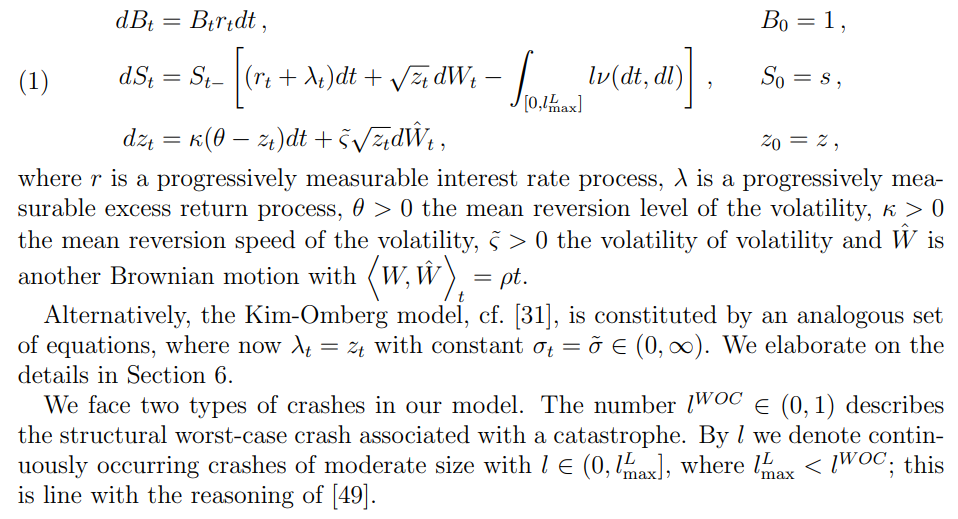

A particularly important choice of those parameters leads to the following version of the Bates model [5] and Heston model [24], respectively:

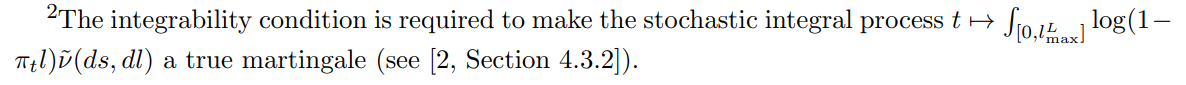

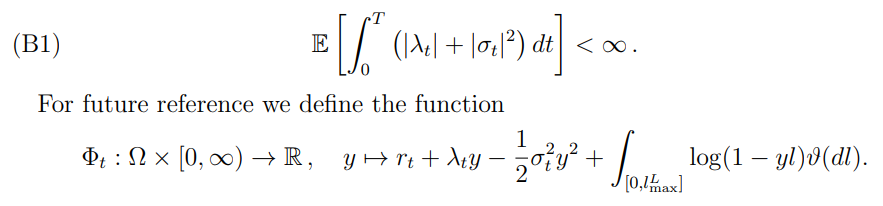

In addition, we need the following integrability assumptions on the market coefficients λ and σ:

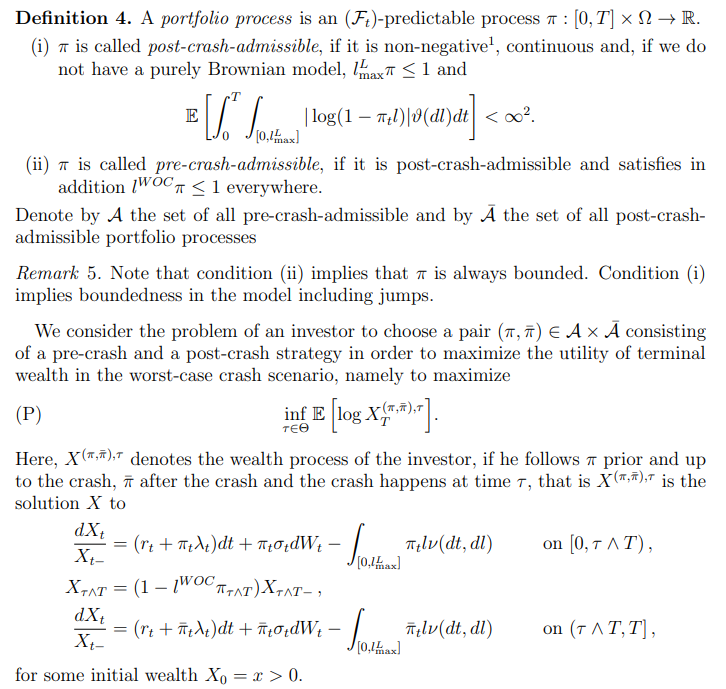

Admissible portfolio processes. We restrict our attention to admissible portfolio processes with continuous paths.

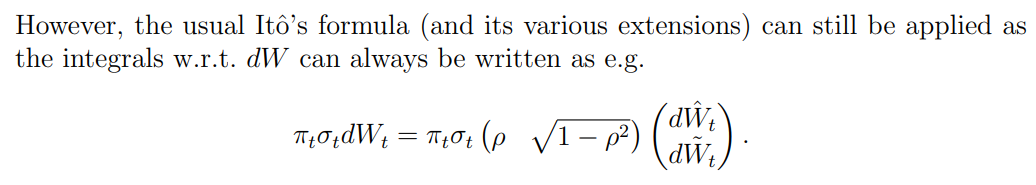

Note that the SDEs above are driven by the Brownian motion W with coefficients that are measurable w.r.t. a larger filtration than the one generated by W only.

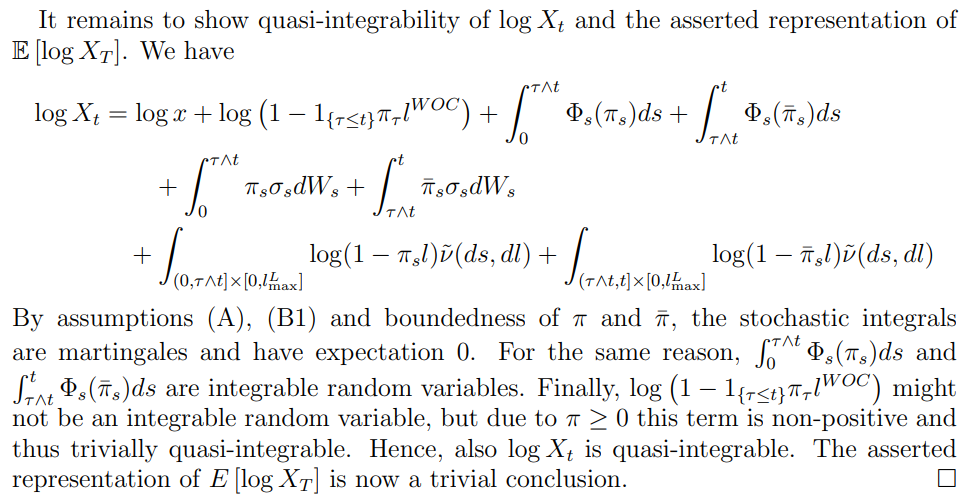

The solution to the above SDE can then be given explicitly:

:::info

Authors:

(1) Sascha Desmettre;

(2) Sebastian Merkel;

(3) Annalena Mickel;

(4) Alexander Steinicke.

:::

:::info

This paper is available on arxiv under CC BY 4.0 DEED license.

:::

[1] This means we rule out short sales of the risky asset.