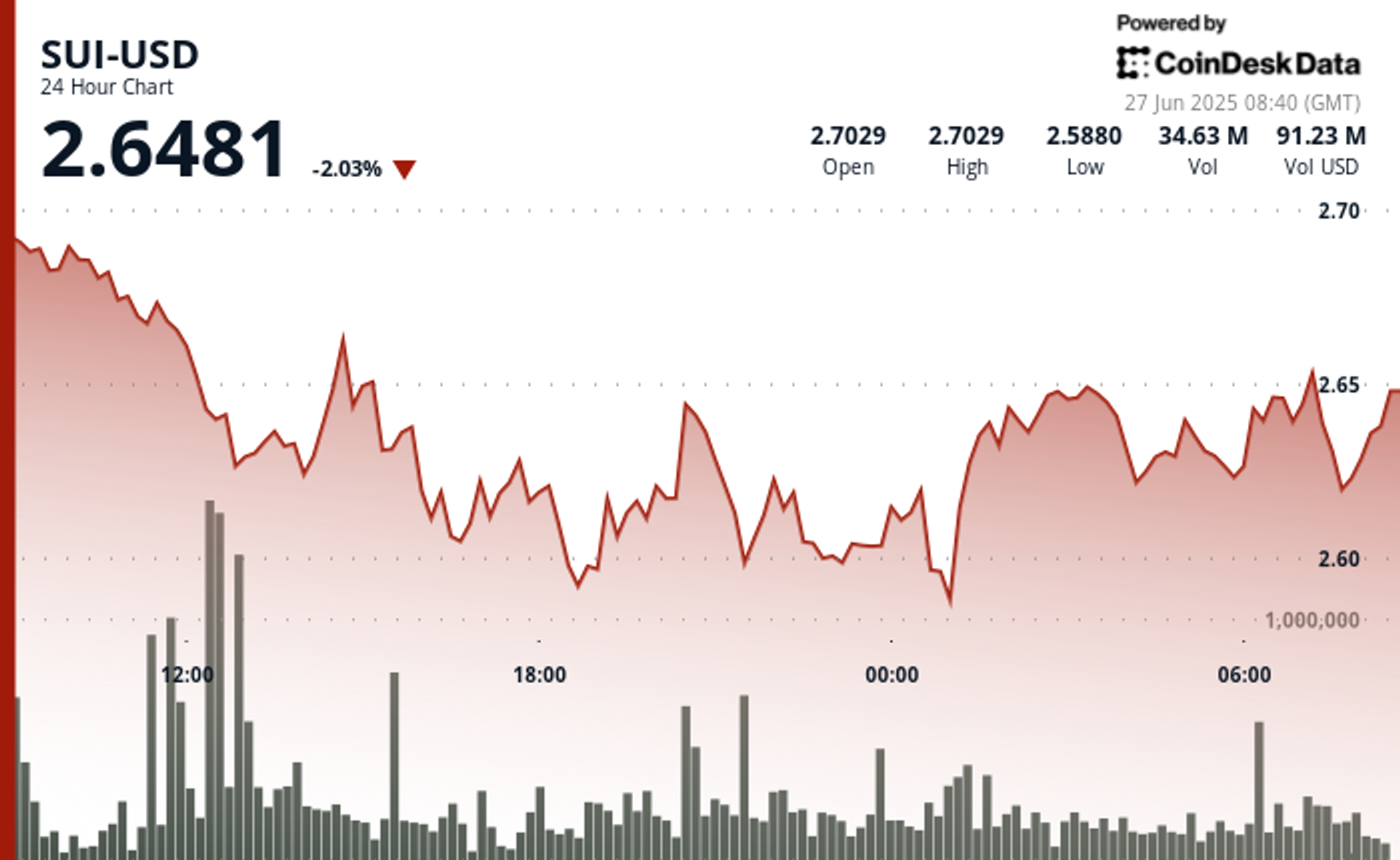

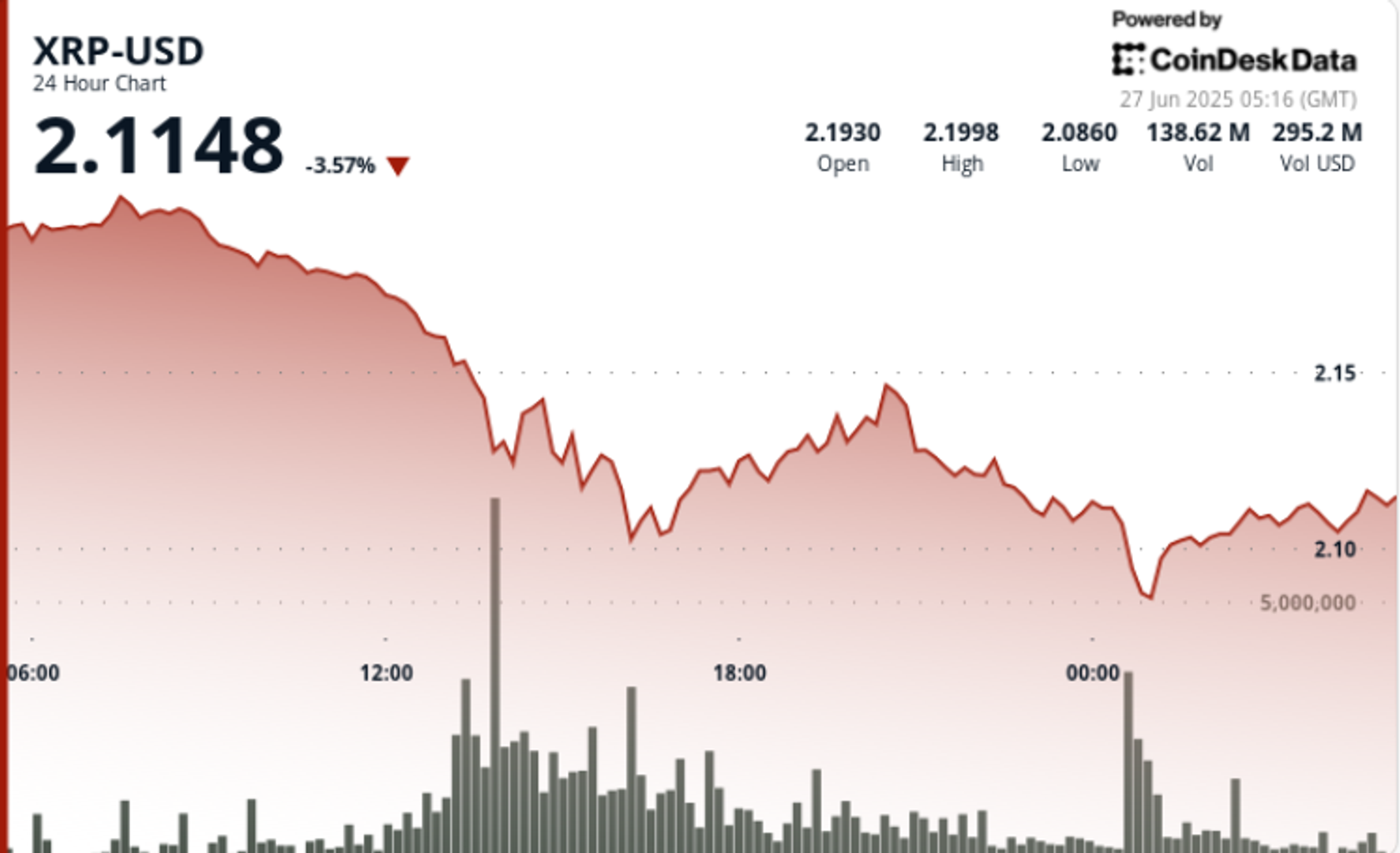

Ripple to Drop Cross-Appeal Against SEC, Ending Years-Long Legal Battle With SEC

The years-long legal battle between Ripple and the U.S. Securities and Exchange Commission (SEC) appears to have finally come to an end, after Ripple Labs CEO Brad Garlinghouse announced Friday that the company plans to drop its cross-appeal in the case. “Ripple is dropping our cross appeal, and the SEC is expected to drop their … Read more